Cca depreciation calculator

The firm had revenues of 20433770. If you claimed CCA for a motor vehicle an aircraft or a musical instrument subtract any non-eligible CCA in column 2A from your total CCA in column 1A.

Depreciation The Cca Inflation Chapter 7 12 Outline Depreciation Defined Types Of Depreciation Before And After Tax Marr Ucc And The 1 2 Yr Rule Ppt Download

Delete LYs Migrated assset Japan.

. At its core a business engineer is a hybrid between a business person and an engineer. Get 247 customer support help when you place a homework help service order with us. Canada Revenue Agency divides depreciable capital properties into many classes and assigns a depreciation rate to each class.

Copy the Total eligible expenses amount from column 3A of Chart 1 and column 3A of Chart 2 to lines 1 and 2 respectively of Part B on the front of the form. Alternatively EAC can be obtained by multiplying the NPV of the project by the loan repayment. Yes Sir There are prescribed forms of application for obtaining consent.

SCMTMSSFIR_CCA Display Charge Correction Advice Document Edit Charge Correction Advice Document. Enter the email address you signed up with and well email you a reset link. Download this list of Federal and Provincial incentives 1.

In finance the equivalent annual cost EAC is the cost per year of owning and operating an asset over its entire lifespanIt is calculated by dividing the NPV of a project by the present value of annuity factor. Depreciation is very fundamental to business tax law. Yes Sir There are prescribed forms of application for obtaining consent.

It enables organizations to anticipate a range of potential failures during the design stage. The total cost of supplies remaining is 300. However answering this question will permit exact staff to more thoroughly verify your employment history education and other information contained in this application and expedite the application process.

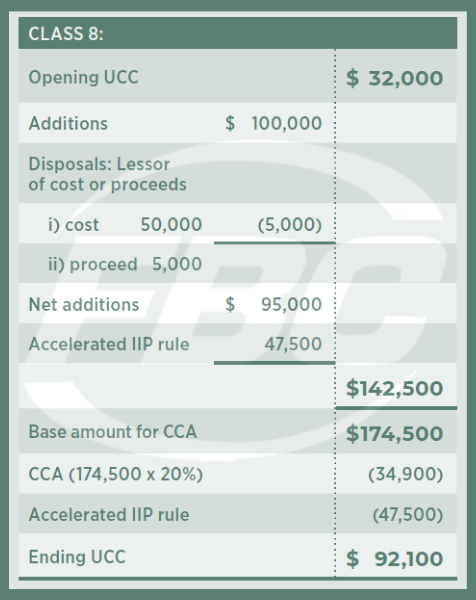

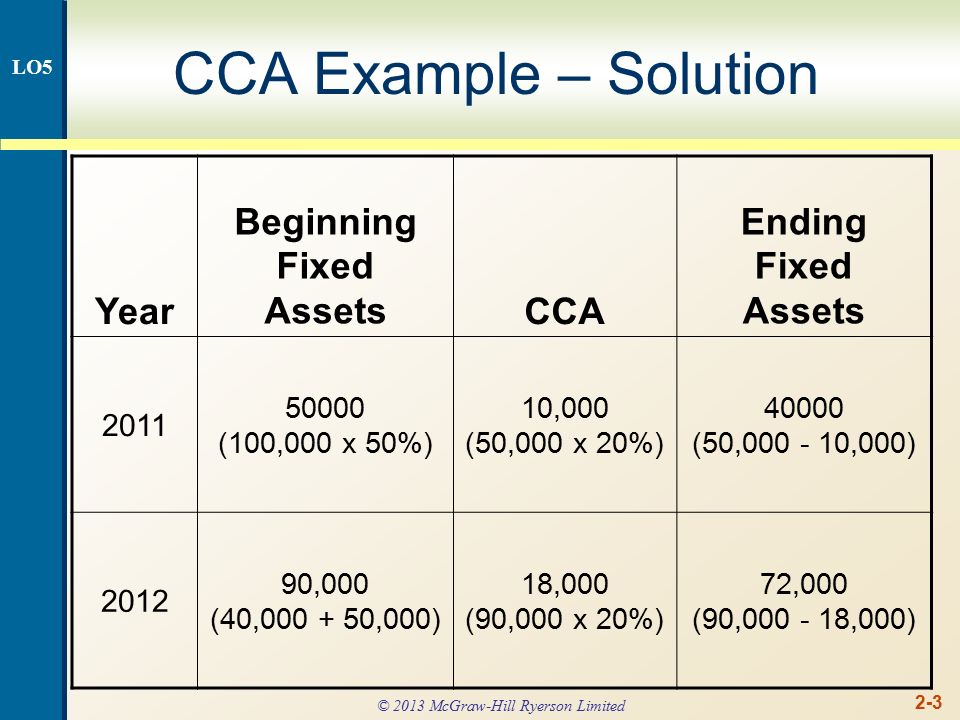

The amount of CCA is a portion of adjusted capitalized cost. This is the gross block without depreciation of all fixed assets. You derive the maximum CCA by multiplying the capital propertys depreciation rate and its adjusted capital cost.

Our global writing staff includes experienced ENL ESL academic writers in a variety of disciplines. QuesIs there any prescribed form for consent application. Responding to the question above is voluntary.

Where where r is the annual interest rate and t is the number of years. Will have R usage as well. Developed in the 1950s the failure mode and effects analysis is one the earliest methodologies of its kind.

Yes Sir There are prescribed forms of application for obtaining consent. We would like to show you a description here but the site wont allow us. Limited amounts of notes for use.

Industries Hotels Capital Investmentin lakhs. A failure mode and effects analysis FMEA is a structured approach to identifying design failures in a product or process. Two of which are.

S are at this from you or i an he have not - which his will has but we they all their were can. Of and to in a is for on that with was as it by be. Each unit will have an open layout with an internal floor area of 32 square metres total floor area of 34 square metres inclusive of air-con ledge.

Industries Hotels Capital Investmentin lakhs. The calculation for the basic tax content also takes into account any depreciation in the value of the property since you last acquired it for example when you purchased it or were last considered to have purchased it. There will be two midterm exams and a cumulative final exam.

This lets us find the most appropriate writer for any type of assignment. If you were unemployed for any length of time please explain. F Record the depreciation of 4000 for this year.

Weve put together all federal and provincially available solar incentives in Canada. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Please review the following 6 ratios.

ACCAs headquarters are in London with principal administrative office in GlasgowACCA works through a network of over. The unadjusted balance of the Supplies account is 1200. QuesIs there any prescribed form for consent application.

Business loan calculator Templates for download Guides Publications In Business. This is the gross block without depreciation of all fixed assets. Federal Incentives and Rebates.

It includes incentives offered by energy efficiency programs and major Canadian municipalities and major LDCs. Canadas federal government provides three solar incentives. CCA Capital cost allowance CCA is the amount of amortization.

QuesIs there any prescribed form for consent application. This is the gross block without depreciation of all fixed assets. Enter the result in column 3A.

Then the depreciation only covers 22 of your income. Course Grade Constitution Homework as explained above 20 Economic Modelling and programming with R Labs 20 2 Midterm exams 30 each Final exam 30. Its interest expense for the year was 1122376 while depreciation expense was 2 Can someone explain how they came up with the answers and whether or not they are correctwhere did 580000 come from  Â.

I encourage students to use a calculator and a ruler in the exams. Migrate Last Years assset Data Japan. A glance at the Business Engineering world.

Migrate Additional Depreciation Codes Japan. The Community Care Apartments are designed to support seniors to live independently while preparing for their future care needs. We would like to show you a description here but the site wont allow us.

Founded in 1904 the Association of Chartered Certified Accountants ACCA is the global professional accounting body offering the Chartered Certified Accountant qualification ACCA. Industries Hotels Capital Investmentin lakhs. If you sell a 500k property earning 40kyear where the depreciation covered 45 of your income and you buy a 1 million property earning 80kyear you get a new 500k to depreciate 18kyear.

Simplex Healthcare net income of 5411623 after paying taxes at 34 percent. It has 233000 members and 536000 future members worldwide. Earnings before interest taxes depreciation and amortization EBITDA is the primary calculation.

CCA x 10110 for a vehicle or. For the list of all applicable GSTHST rates go to GSTHST calculator and rates. The business engineer is someone with the understanding of how the business world works ad macro level combined with how organisms function at a micro level that can architecture solutions based on several key elements.

What Is The Purpose Of Cca How Is It Calculated Why Are Items Typically Pooled Into The Same Cca Class Intermediate Canadian Tax

Capital Cost Allowance For Farmers Fbc

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

Tax Shield Formula Step By Step Calculation With Examples

Some Cca Classes Table Ppt Video Online Download

Calculating The Capital Cost Allowance Cca Youtube

Solved 2 A Given The Following Income Statement Calculate Chegg Com

Capital Cost Allowance Calculation 2 Youtube

Cca Calculation Youtube

Tax Shield Formula Step By Step Calculation With Examples

Capital Cost Allowance Canada Youtube

Present Value Of Tax Shield On Cca Evaluation And Computations In Corporate Finance Lecture Slides Slides Corporate Finance Docsity

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download

2

Capital Cost Allowance Cca For Canadian Assets Depreciation Guru

Tax Shield Formula Step By Step Calculation With Examples

10 0 Capital Cost Allowance Cca Cca Is Depreciation For Tax Purposes The Depreciation Expense Used For Capital Budgeting Should Be Calculated According Ppt Download